pixa (Private Investment Exchange Australia) is Australia's first unlisted asset messaging platform.

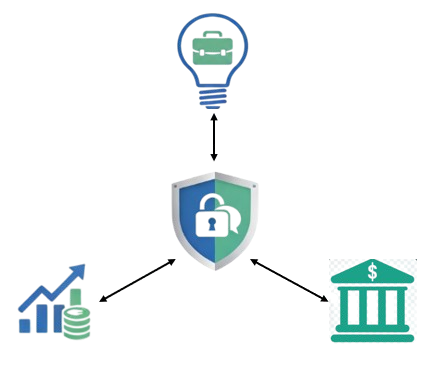

pixa is a purpose-built, secure messaging platform for the unlisted asset ecosystem.

By facilitating efficient and transparent information exchange in real time, we eliminate inefficient workflows and simplify communication between asset managers, custodians, private companies and legal teams.

Streamline communication with stakeholders and manage deal flow efficiently in a secure environment.

Secure communication, auditable records of communication and document management integrated with custody operations.

Collaborate securely across client teams and custodians with audit trails and access control.

Facilitate and maintain transparent and compliant communication with stakeholders.

We are a team of innovative financial services professionals with over 100 years of experience combined. Working in the financial services industry, we understand first-hand the largest communication challenge in the unlisted asset market is the lack of a centralised, secure, transparent and real-time communication.

This is where pixa comes in!

Meet the founders:

Mark's career in financial services began in 1981. He has worked for fund managers, stockbrokers, insurers and superannuation fund administrators. He has been a director of trustees and responsible entities and has sat on a number of compliance committees. Mark is an expert in finding solutions to the operational challenges of pooled investment vehicles.

Teresia has a wealth of experience and expertise in sales, business development, relationship management, strategy and implementation. Teresia has worked for global organisations and built their local presence and increased their market share into significant players.

The unlisted assets sector, encompassing private equity, venture capital, infrastructure, private credit, and family-owned enterprises, is experiencing unprecedented growth. However, its communication infrastructure remains fragmented and insecure. pixa solves this by providing a secure, compliant, and tailored messaging platform for stakeholders in this space.

pixa is not just a communication tool, it’s infrastructure built for the future of private markets. As unlisted assets become a larger share of global portfolios, pixa will be essential for enabling secure, compliant, and collaborative ecosystems.

Unlisted asset transactions involve highly sensitive information, often shared across asset managers, custodians, legal teams, and company executives. However, communication in private market remains fragmented and insecure, exposing stakeholders to avoidable risk. Below are 5 messaging risks and the solutions to avoid them.

Email, SMS and consumer-grade messaging apps offer limited encryption and no enterprise-grade controls. A breach can result in serious reputational and financial consequences.

Solution: Use a secure, enterprise-messaging platform with end-to-end encryption and strict access control.

Many jurisdictions now require communication related to financial transactions to be archived and retrievable. Using non-compliant tools may lead to reputational risk, fines and regulatory penalties.

Solution: Ensure your communication tools are audit-ready and comply with jurisdictional regulations.

Tracking who said what, when, and to whom is often impossible with disconnected tools. This lack of traceability complicates due diligence and dispute resolution.

Solution: Centralize messaging and file sharing with built-in audit tags.

Delayed messages, missed threads, and unclear instructions can slow down time-sensitive deals.

Solution: Use real-time messaging with tagging, search and task assignment features to maintain velocity.

With multiple legal, financial, and executive parties involved, miscommunication is costly and common.

Solution: Use a platform that enables group threads, secure channels, and context-rich communication.

In 2025, the unlisted asset landscape in Australia is under greater regulatory scrutiny than ever before. Institutional investors, including superannuation funds, continue to increase their allocations to private equity, infrastructure, property, and private credit, creating both opportunity and challenges.

Below are the key regulatory trends shaping unlisted assets in 2025, and what market participants need to be aware of.

Regulators, particularly ASIC and APRA, are tightening expectations around how unlisted assets are valued and reported. For example:

What this means for you: Communication between various stakeholders, fund managers, and custodians must be transparent, timestamped, and auditable. Platforms like pixa help ensure that critical decisions and documents are exchanged in a compliant, secure, and structured environment.

From 1 July 2025, APRA’s CPS 230 standard on Operational Risk Management takes effect. This builds on previous requirements like CPS 234 (Information Security), but with stronger expectations around service provider management, incident response, and operational continuity. This means:

pixa's role: As a secure messaging platform, we help reduce operational risk by eliminating reliance on unstructured communication like email, improving traceability, and ensuring encrypted, access-controlled information exchange.

The Treasury and ASIC are turning attention to the governance of related-party dealings within unlisted assets, particularly where trustees, asset managers, or platforms may be exposed to conflicts of interest.

In 2025, we’re seeing:

pixa's role: Keeping a complete audit trail of all messaging and attachments is critical. pixa provides this out-of-the-box, eliminating the need to dig through scattered email chains during a compliance review.

Australia continues to align with global data protection standards, but regulators are paying closer attention to where data is stored, who can access it, and under what jurisdiction.

As unlisted investments become more global, fund managers must:

pixa's edge: We are designed with compliance in mind. Our infrastructure and encryption practices support Australian data requirements, giving firms control over sensitive information.

Unlisted assets now form a core component of many superannuation portfolios, and APRA has raised the bar on investment governance.

Superannuation investment governance is changing in the following ways:

How pixa helps: We provide a secure, structured messaging environment for the full lifecycle of an investment, ensuring clarity, compliance, and accountability.

2025 is not a year for business-as-usual. As the regulatory lens intensifies, private market participants must modernise how they communicate, document, and defend their decisions.

At pixa, we believe secure messaging is foundational, not just for mitigating risk, but for building trust with regulators, investors, and counterparties.

In the private asset market, communication is a vital but often underestimated component of performance. As the market expands in both size and complexity, the traditional communication tools relied upon for decades - emails, spreadsheets, ad hoc calls - are increasingly failing to meet operational and regulatory demands.

Private markets are experiencing unprecedented growth. According to a 2023 report by Bain & Company, global private capital assets under management are projected to exceed USD 30 trillion by 2030, more than double their 2022 levels.

Despite this rapid expansion, communication infrastructure has lagged behind. Many market participants still rely on email threads, shared drives, and manual data entry to coordinate on high-value, high-risk transactions.

Technology is closing this gap by transforming how private market stakeholders communicate and collaborate. The most impactful solutions are purpose-built platforms that cater specifically to the unique needs of unlisted assets.

Key advancements include:

These tools enable stakeholders to operate with greater clarity, speed, and confidence across complex deal flows and investor engagements.

While the benefits are clear, adoption of communication technology in private markets is still uneven. Common barriers include:

Modern platforms are tackling these concerns directly. Solutions like pixa are lightweight, role-based, and easy to adopt, with minimal disruption to existing workflows. Most importantly, they are built with enterprise-grade security at the core, ensuring that sensitive communications are fully protected.

pixa is redefining how private assets are valued, combining AI-driven insights with industry best practices to deliver fast, consistent, and transparent valuations.

Regulators, particularly APRA, are raising the bar for how private assets are priced and reported.

Key areas under scrutiny include:

pixa helps organisations meet these expectations through a standardised, AI-powered framework for valuing private companies, ensuring consistency, transparency, and compliance across the board.

To learn more about how pixa can benefit your business or to book a demo, please reach out to our friendly team via email or call Teresia Hajdu.

Email: admin@pixa.net.au

Phone: +61 409 461 530